Content

Assets typically hold positive economic value and can be liquified (turned into cash) in the future. However, some assets are less liquid than others, making them harder to convert to cash. For example, https://www.bookstime.com/articles/the-accounting-equation-may-be-expressed-as inventory is very liquid — the company can quickly sell it for money. Real estate, though, is less liquid — selling for cash is time-consuming and sometimes difficult, depending on the market.

The accounting equation shows how a company’s assets, liabilities, and equity are related and how a change in one typically results in a change to another. In the accounting equation, assets are equal to liabilities plus equity. Accumulated Other Comprehensive Income (Loss), AOCIL, is a component of shareholders’ equity besides contributed capital and retained earnings. This equation contains three of the five so called “accounting elements”—assets, liabilities, equity. The remaining two elements, revenue and expenses, are still important (and you still need to track them) because they indicate how much money you are bringing in and how much you are spending.

The accounting equation formula is: Assets = Liabilities + Owners’ or Stockholders’ Equity.

AssetsAnything which is the possession of a business including the amounts due to it from others is called an asset. Capital increases or other liability increases or asset decreases. Capital decreases or other liability decreases or asset increases. Capital decreases or liability decreases or other asset increases. Capital increases or liability increases or other asset decreases. Not all companies will pay dividends, repurchase shares, or have accumulated other comprehensive income or loss.

The first format is the fundamental accounting equation used in financial reporting. Accountants used the second and third format for analysis purposes. The most important thing to remember is that the equation must be in balance at any given time. Unearned revenue represents a customer’s advanced payment for a product or service that has yet to be provided by the company. Since the company has not yet provided the product or service, it cannot recognize the customer’s payment as revenue, according to the revenue recognition principle. The company owing the product or service creates the liability to the customer.

What is the Expanded Accounting Equation?

As each month passes, the company will adjust its records to reflect the cost of one month of insurance usage. Let’s continue our exploration of the accounting equation, focusing on the equity component, in particular. Recall that we defined equity as the net worth of an organization. It is helpful to also think of net worth as the value of the organization.

Additionally, you can use your cover letter to detail other experiences you have using the equation. For example, you can talk about how you checked that the books were balanced for a friend or family member’s small business. And we find that the numbers do balance, meaning Apple has been reporting transactions accurately, and its double-entry system is working.

What Are Assets, Liability and Equity?

One of the main benefits of using the accounting equation is the fact that it provides an easy way to verify the accuracy of your bookkeeping. On the other hand, if the equation balances, it is a good indication that your finances are on the right track. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses.

These financial statements give a quick overview of the company’s financial position. The accounting equation makes sure the balance sheet is balanced, showing that transactions are recorded accurately. In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance. These retained earnings are what the company holds onto at the end of a period to reinvest in the business, after any distributions to ownership occur.

Assets represent the valuable resources controlled by the company, while liabilities represent its obligations. Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. Understand what the accounting equation is, learn the elements of the basic accounting equation, and see examples. At this point, let’s consider another example and see how various transactions affect the amounts of the elements in the accounting equation.

- Barbara has an MBA from The University of Texas and an active CPA license.

- However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization.

- The shareholders’ equity number is a company’s total assets minus its total liabilities.

- In terms of results, in double-entry accounting both sides of the accounting equation are required to balance out at all times.

- We show formulas for how to calculate it as a basic accounting equation and an expanded accounting equation.

- Second, it can borrow the money from a lender such as a financial institution.

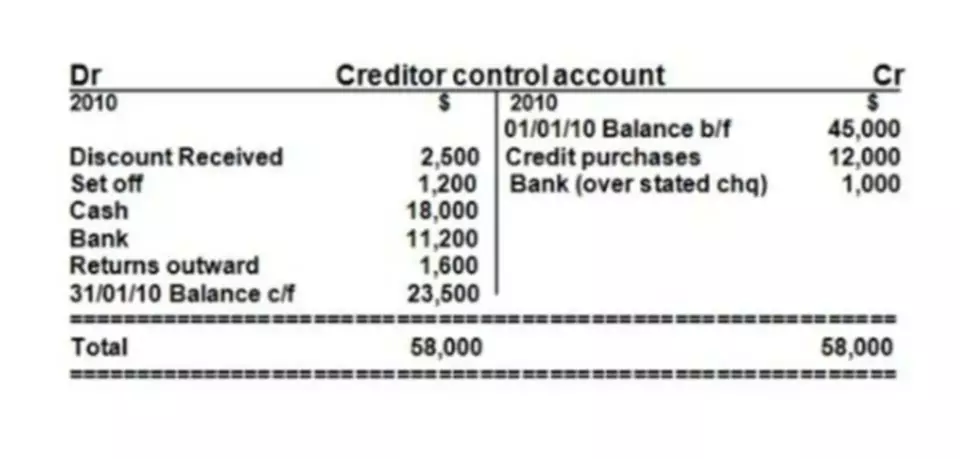

As a result of this transaction, an asset (i.e., cash) increases by $10,000 while another asset ( i.e., merchandise) decreases by $9,000 (the original cost). On the other side of the equation, a liability (i.e., accounts payable) is created. Creditors have preferential rights over the assets of the business, and so it is appropriate to place liabilities before the capital or owner’s equity in the equation.